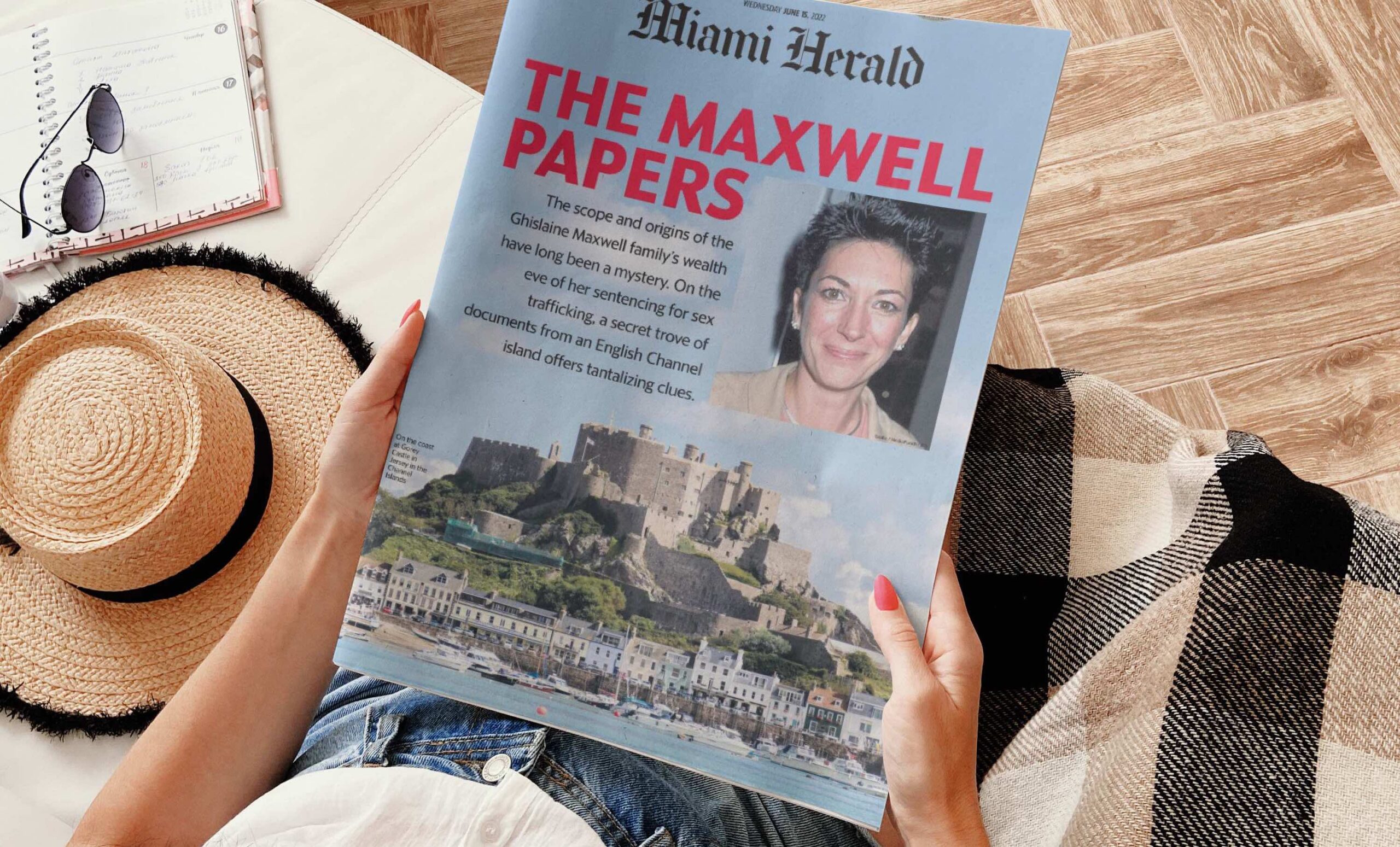

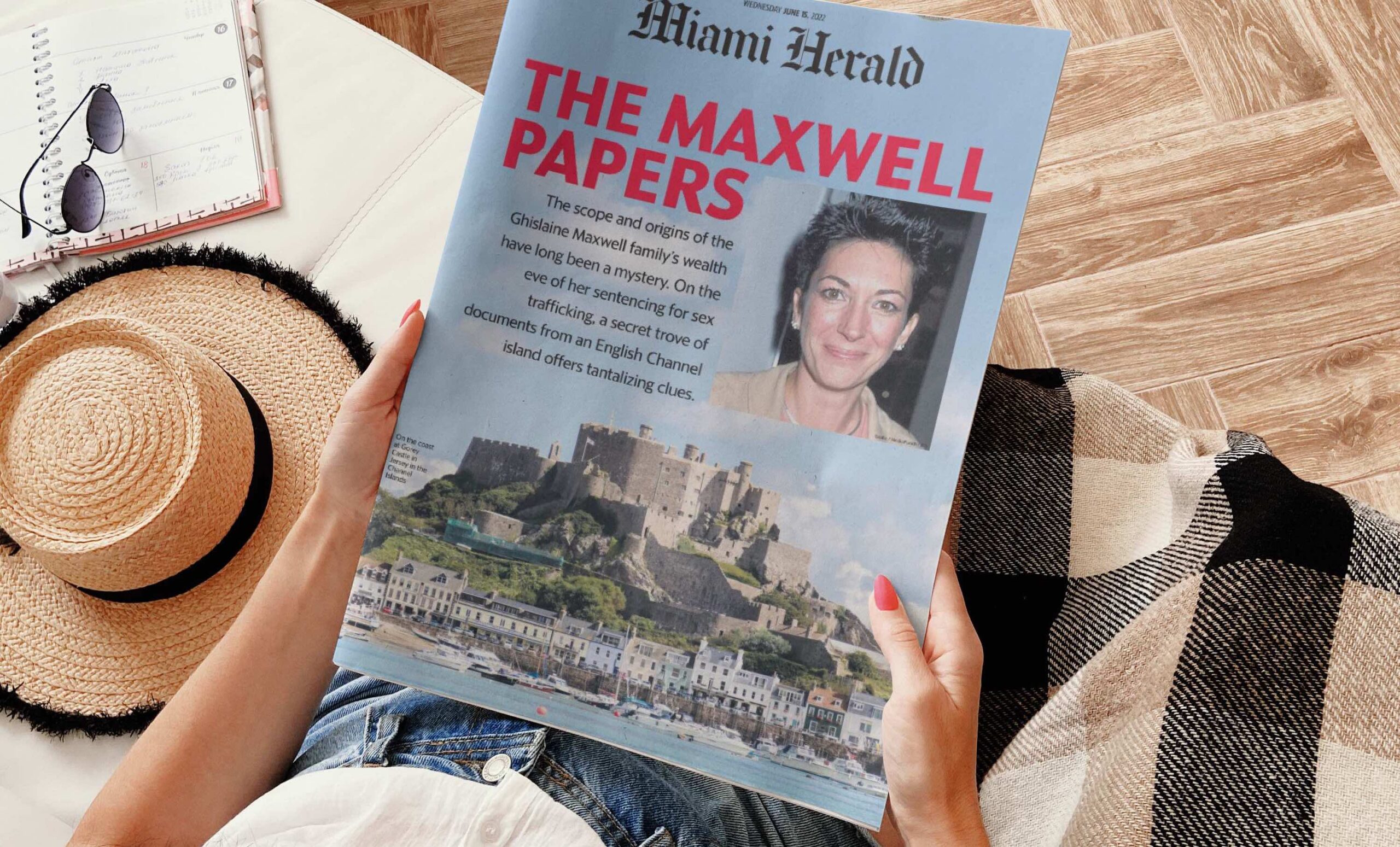

Offshore leak exposes financial secrets of Ghislaine Maxwell’s family

Jeffrey Epstein and Ghislaine Maxwell occupied the highest reaches of society, hobnobbing with royalty and world leaders while hopscotching the globe on Epstein’s private jets.

Jeffrey Epstein and Ghislaine Maxwell occupied the highest reaches of society, hobnobbing with royalty and world leaders while hopscotching the globe on Epstein’s private jets.