Every story begins with a question. For the past 20 years, I’ve been lucky enough to ask questions for Newsweek, Institutional Investor, The Financial Times, Barron’s, CNN, Fortune, Bloomberg, Marie Claire, Forbes, The Huffington Post, The Independent, The Guardian and others.

I got my start as a student with the Dow Jones Newspaper Fund and won awards as a special writer, editor and foreign correspondent for Dow Jones Newswires and The Wall Street Journal. As finance editor for Newsweek, I was a finalist for the National Magazine Award. I occasionally write columns and opinion pieces and I also write books, which you can find on this site.

Every story begins with a question. For the past 20 years, I’ve been lucky enough to ask questions for Newsweek, Institutional Investor, The Financial Times, Barron’s, CNN, Fortune, Bloomberg, Marie Claire, Forbes, The Huffington Post, The Independent, The Guardian and others.

I got my start as a student with the Dow Jones Newspaper Fund and won awards as a special writer, editor and foreign correspondent for Dow Jones Newswires and The Wall Street Journal. As finance editor for Newsweek, I was a finalist for the National Magazine Award. I occasionally write columns and opinion pieces and I also write books, which you can find on this site.

Crypto’s Tax

Shelter Problem

January 11, 2023

but for blowup-prone crypto companies and investors, it’s an

increasingly problematic one. (Part of the crypto column series.)

Among the many stunning statements made by FTX’s chief executive, John J. Ray III, shortly before the arrest of Sam Bankman-Fried, the disgraced founder and ex-CEO of the bankrupt Bahamas cryptocurrency exchange, one stood out: “Mr. Bankman-Fried, whose connections and financial holdings in the Bahamas remain unclear to me, recently stated to a reporter on Twitter, ‘F— regulators, they make everything worse,’” Ray observed in a declaration to the U.S. Bankruptcy Court for the District of Delaware.

Crypto’s Tax

Shelter Problem

January 11, 2023

but for blowup-prone crypto companies and investors, it’s an

increasingly problematic one. (Part of the crypto column series.)

Among the many stunning statements made by FTX’s chief executive, John J. Ray III, shortly before the arrest of Sam Bankman-Fried, the disgraced founder and ex-CEO of the bankrupt Bahamas cryptocurrency exchange, one stood out: “Mr. Bankman-Fried, whose connections and financial holdings in the Bahamas remain unclear to me, recently stated to a reporter on Twitter, ‘F— regulators, they make everything worse,’” Ray observed in a declaration to the U.S. Bankruptcy Court for the District of Delaware.

Magic larp

The harsh reality of living the millennial dream

December 1, 2022

When I was young, I spent most of my free time reading books.

I was insatiable. As soon as I could read, I would take out multiple volumes at the library and absorb them as fast as I could. I’d juggle several at once, swallowing large tomes simultaneously, then racing on to the next. I volunteered at my town’s school and local libraries – and, eventually, other towns’ libraries – cruising the aisles and scouring the card catalogs, looking for exactly what I wanted. And when I finally could earn an allowance, I spent all my savings at the mall’s solitary bookstore.

What was I after? Fairy tales, fantasy, folklore, fiction. Imagination stimulation of any kind.

Magic larp

The harsh reality of living the millennial dream

December 1, 2022

When I was young, I spent most of my free time reading books.

I was insatiable. As soon as I could read, I would take out multiple volumes at the library and absorb them as fast as I could. I’d juggle several at once, swallowing large tomes simultaneously, then racing on to the next. I volunteered at my town’s school and local libraries – and, eventually, other towns’ libraries – cruising the aisles and scouring the card catalogs, looking for exactly what I wanted. And when I finally could earn an allowance, I spent all my savings at the mall’s solitary bookstore.

What was I after? Fairy tales, fantasy, folklore, fiction. Imagination stimulation of any kind.

The Death of Crypto Has Been Greatly Exaggerated, Again

October 28, 2022

Crypto’s descent into hell, rather than sending institutional investors straight for the exits, has triggered a hunt for the next big bet. (Part of the crypto column series.)

There is a curious page tucked away in the folds of the internet that proclaims Bitcoin has died more than 460 times.

By that website’s count, the cryptocurrency has been vanquished 24 times so far this year, after dying 47 times in 2021 and 14 times in 2020. Its death rate peaked in 2017 — the year Bitcoin shot to a then-record high near the symbolic $20,000 handle in December, only to fall below $11,000 five days later, shedding 45 percent of its value. That year, the cryptocurrency apparently met its demise no fewer than 124 times. Perhaps only Prometheus has been felled, only to regenerate, quite so many times.

America’s Much-Vaunted, Mythological CBDC

August 1, 2022

Since the start of the year, much ballyhoo has been made about central bank digital currencies, also known as CBDCs (an acronym that’s as clunky and vexatious as the discussions surrounding CBDCs themselves).

A CBDC is, according to the U.S. Federal Reserve, a digital form of fiat currency — effectively, electronic cash — fully backed by the central bank and “widely available to the general public.”

A minor detail that the Fed does not mention: American CBDCs are not widely available to the general public, because they don’t exist.

The Death of Crypto Has Been Greatly Exaggerated, Again

October 28, 2022

Crypto’s descent into hell, rather than sending institutional investors straight for the exits, has triggered a hunt for the next big bet. (Part of the crypto column series.)

There is a curious page tucked away in the folds of the internet that proclaims Bitcoin has died more than 460 times.

By that website’s count, the cryptocurrency has been vanquished 24 times so far this year, after dying 47 times in 2021 and 14 times in 2020. Its death rate peaked in 2017 — the year Bitcoin shot to a then-record high near the symbolic $20,000 handle in December, only to fall below $11,000 five days later, shedding 45 percent of its value. That year, the cryptocurrency apparently met its demise no fewer than 124 times. Perhaps only Prometheus has been felled, only to regenerate, quite so many times.

America’s Much-Vaunted, Mythological CBDC

August 1, 2022

Since the start of the year, much ballyhoo has been made about central bank digital currencies, also known as CBDCs (an acronym that’s as clunky and vexatious as the discussions surrounding CBDCs themselves).

A CBDC is, according to the U.S. Federal Reserve, a digital form of fiat currency — effectively, electronic cash — fully backed by the central bank and “widely available to the general public.”

A minor detail that the Fed does not mention: American CBDCs are not widely available to the general public, because they don’t exist.

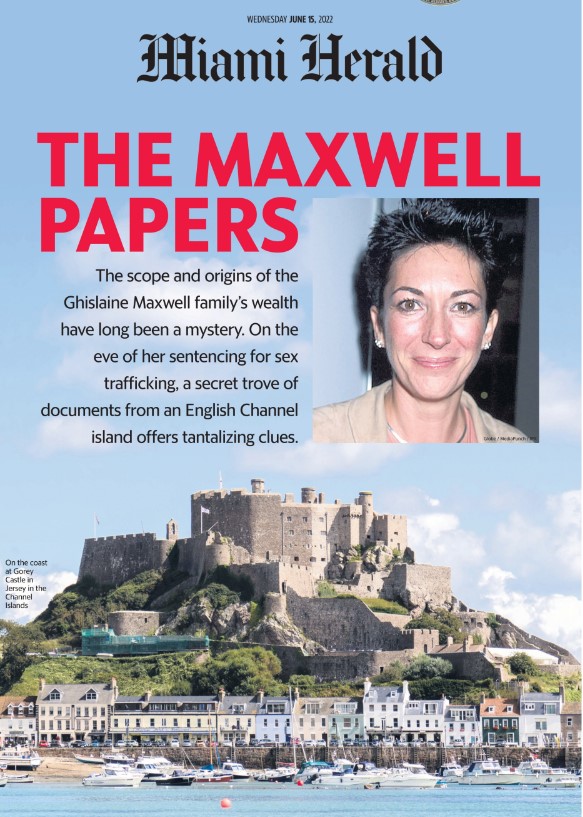

Offshore leak exposes financial secrets of Ghislaine Maxwell’s family

June 15, 2022

Jeffrey Epstein and Ghislaine Maxwell occupied the highest reaches of society, hobnobbing with royalty and world leaders while hopscotching the globe on Epstein’s private jets.

Maxwell’s sex-trafficking trial last December, which resulted in her conviction on five of six counts, with sentencing scheduled for late this month, showed how the pair used their money, power and vast global connections to recruit, groom and sexually abuse girls across multiple continents.

Latest Stories

Is Bitcoin Too Big to Fail?

Even as the cryptocurrency hits record highs, threats to its long-term success remain. (Part of the crypto column series.)

Warren Buffett May Not Be Into Crypto, but His Granddaughter Is

Warren Buffett May Not Be Into Crypto, but His Grand-daughter IsWith record volumes and sales exploding into the billions, NFTs are red hot — and for artists like Nicole Buffett, a pandemic-proof way to sell art. Leah McGrath GoodmanInstitutional InvestorSeptember 24,...

He Waited 17 Years to Be Denied an SEC Whistleblower Award

After reaping more than $50 million from a sprawling fraud uncovered by Eugene Ross, the SEC has handed down a final order denying him any award.

Film

Dark Secrets of a Trillion Dollar Island: Garenne tells the extraordinary story of the child abuse scandal that erupted on the idyllic island of Jersey in 2007. For a long time, the victims’ voices had remained unheard, but when widespread allegations of sexual abuse resurfaced in the late 2000s, Jersey’s then health minister Stuart Syvret spoke out about the scale of this historic child abuse and the damage done to the victims.