The Asylum: Inside the Rise and Ruin of the Global Oil Market

The Asylum is a stunning expose by a seasoned Wall Street journalist that once and for all reveals the truth behind America’s oil addiction in all its unscripted and dysfunctional glory.

In the tradition of Too Big to Fail and Liar’s Poker, author Leah McGrath Goodman tells the amazing-but-true story of a band of struggling, hardscrabble traders who, after enduring decades of scorn from New York’s stuffy financial establishment, overcame more than a century of failure, infighting, and brinksmanship to build the world’s reigning oil empire–entirely by accident.

Reviews

What they’re saying…

“A history of the famous (and infamous) oil-futures marketplace, the Nymex. This is a rollicking, fast-paced, decades-long tale of a marketplace that sprang out of — no kidding — a potato futures market. The pit where most trading took place is still active in New York City, but in just the past few years much of it has moved online, and is handled by computers able to rapidly process reams of data (note that this move hasn’t yielded more stable prices in fact one could argue the opposite case). The reporter, who worked for many years as a Dow Jones reporter covering the market, has many solid relationships with the traders who built the Nymex and this adds a lot of color to the narrative. When the instability of supply and relentless demand drives up price levels and volatility, many of these traders do very well indeed. And when that happens, the partying really kicks into high gear.”

– National Resources Defense Council

reviews

More Praise for The Asylum:

Inside the Rise and Ruin of the Global Oil Market

Bloomberg BusinessWeek

“Finance journalist Goodman traces Nymex’s transformation into a colossus with a stranglehold on the sale of the world’s energy. Goodman explores the lurid culture of Nymex traders, scruffy hustlers who shriek, swear and bring guns, drugs, and hookers right into the trading pit. One of the year’s most colorful business histories.” “

Publishers Weekly

Institutional Investor

“In the complex world of the energy markets where pit trading is a blue-collar profession, Goodman captures the grit and spirit of the floor and the personalities in the board room…her depiction of the players and the place to rings true.”

Reuters

But wait, there’s more

Relate Stories

Wall Street Firm Founded by Trump’s Army Secretary Nominee Violated Trading Rules for Years

Virtu Financial, the giant Wall Street high-frequency trading firm run by President-elect Donald Trump’s nominee for secretary of the Army, Vincent Viola, has a record of violating the rules of the U.S. Securities Exchange Act, the Nasdaq Stock Market, the New York Stock Exchange and other exchanges that extends back nearly as long as the firm has been in business, according to U.S. market regulatory filings reviewed by Newsweek.

How Credit Card Companies Prey on Millennials

How Credit Card Companies Prey on Millennials Leah McGrath GoodmanNewsweekAugust 18, 2016hen Kelly Dilworth applied for a Discover card in July, she was happy to learn that her spending limit was $13,000—a level most card companies don't offer...

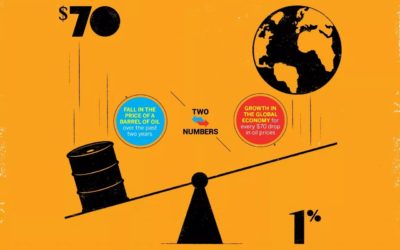

Wall Street May Be Panicking About the Swings in Oil Prices—But You Shouldn’t

Wall Street May Be Panicking About the Swings in Oil Prices—But You Shouldn'tLeah McGrath GoodmanNewsweekFebruary 3, 2016he headlines tell us that oil's fall below $30 a barrel in January and loss of nearly 50 percent of its value in 2015 could...